Try our new free GreenChoice - Food Scanner mobile app!

DOWNLOAD-

-

-

Diets

Allergies

Take our 30-second quiz & we’ll filter our site to show only products that match your dietary preferences.

- GCNow

- What’s an ESG Score? A Guide to Company ESG Reporting, Ratings, & Issues

What’s an ESG Score? A Guide to Company ESG Reporting, Ratings, & Issues

Author: Galen Karlan-MasonPublished: August 23, 2022

What is an ESG score?

Environmental, Social, Governance (ESG) is a framework for evaluating a company’s interactions with the planet, society, and its employees.

ESG scores are meant to distill corporate ESG reports and measure how well a company manages near and long-term environmental, social, and governance risks to the company.

- Environmental factors may include a company’s carbon footprint or its policies on renewable energy.

- Social factors may include a company’s treatment of employees or its involvement in charitable giving.

- Governance factors may include a company’s board structure or its executive compensation practices.

Who uses ESG scores?

ESG ratings are most commonly used by investors and banks, to help them evaluate corporate investment and lending decisions. ESG ratings are also used by companies to understand and measure their ESG risks, to track their performance, and to improve their risk management.

ESG factors can be used to evaluate a company’s sustainability and its potential environmental and ethical risks and opportunities, however, ESG ratings do not necessarily measure a company’s current sustainability practices or impacts.

Asset managers use ESG criteria in the investment analysis and portfolio selection of $16.6 trillion in assets–that’s 32% of the total U.S. assets under professional management (source).

Sustainable mutual funds and ESG-focused ETFs rose 53% in 2021 to represent $2.7 trillion in assets (source), and ESG Funds totalled $649 billion, up nearly 20% from $542 billion in 2020 (source).

Many public corporations, and a growing number of private companies, use ESG frameworks to evaluate, measure, benchmark, and report their business practices and plans.

“92% of S&P 500 companies and 70% of Russell 1000 companies published sustainability reports in 2020” (source). And 79% of venture and private equity-backed companies and 67% of privately owned companies have ESG initiatives in place (source).

Unfortunately, the ESG space is rife with greenwashing, by fund managers and reporting companies alike. More on ESG greenwashing, efforts to prevent it, and new technology enabling investors and companies to evaluate corporate sustainability and risk factors based on actual company practices.

Why is ESG becoming so popular?

Two convering inflection points are driving ESG adoption. A generational shift to conscious consumption and capital combined with inequivocal science linking linking humans to climate change and global zero emissions targets together are driving a demand surge for corporate sustainability and transparency and a framework for evaluating investments through a new lens that considers companies’ environmental, social, and governance performance.

Conscious Consumption & Impact Capital

The conscious consumer movement is characterized by the generational shift to prioritize purpose. Millennials and Gen Z are trying to make healthy choices and positive impact through their purchases, voting with their dollars for ethical and sustainable businesses that share their values. This is driving a need for companies to understand their products health and sustainability impacts and communicate them transparently.

Corporate Sustainability & ESG Reporting

The corporate sustainability and ESG movement is characterized by measuring, understanding, reporting, and investing in sustainable and ethical business practices that support public health, foster social equity, and protect the planet. Its a response to inequivacable science linking humans to a (preventable) climate crisis in our lifetime, increasing demand from conscious consumers, and pressure from regulators.

Facts exemplifying the generational shift to conscious capital and corporate sustainability:

- $30+ trillion (the largest generational transfer of wealth in history) is passing into the hands of Millenials–rapidly accelerating a shift to conscious consumption and impact investing.

- 65% of the world economy will become “carbon-neutral” with businesses tracking their environmental footprints.

- US SEC has proposed a rule mandating companies to disclose climate related risks and GHG emissions from scope 1 & 2, and scope 3 when material.

- COP26 has catalyzed “net zero by 2050” pledges from private financial institutions representing $130 trillion in assets, which will accelerate tracking and reporting in the consumer goods industry.

What are the common misconceptions about ESG scores?

The first big misconception about ESG investing is that it is synonymous with “sustainability investing”; it is not. In fact, there are many companies with high ESG scores that are neither sustainable nor ethical.

The second big misconception is that ESG ratings measure a company’s impact on the planet when in reality they indicate a company’s exposure to risks associated with environmental, social, and governance issues.

What do ESG scores measure?

ESG ratings measure a company’s theoretical risk exposure to environmental, social, and governance issues. ESG ratings do NOT measure a company’s sustainability.

Environmental ESG Metrics

Environmental ESG metrics include:

- Greenhouse gas emissions and reduction targets (scope 1 & 2)

- Carbon footprints of the company’s products &/or services (includes scope 3)

- Water footprint and reduction targets

- Land use and biodiversity impacts, management, & protection

- Resource use, pollution, & waste management

Social ESG Metrics

Social ESG metrics include:

- Public health

- Public health impacts of company operations

- Health impacts of using the company’s products &/or services

- Worker rights & diversity

- Living wages and pay gaps

- Employee & leadership diversity

- BIPOC & LGBTQ policies and support systems

- Occupational health & safety

- Community relations and impacts

Governance ESG metrics

Governance ESG metrics include:

- Data privacy and security

- Capital risk management

- Transparency and reporting

- Integrity, corruption, and auditing practices

Considering Supply Chain ESG & Scope 3 Impacts

Companies reporting on ESG and those evaluating a companies ESG performance need to consider the full life-cycle of a companies products and/or services. This means evaluating a company’s supply chain across the ESG metrics listed above, as well as the sustainability impacts of using a company’s products through their end of life.

Who calculates ESG scores?

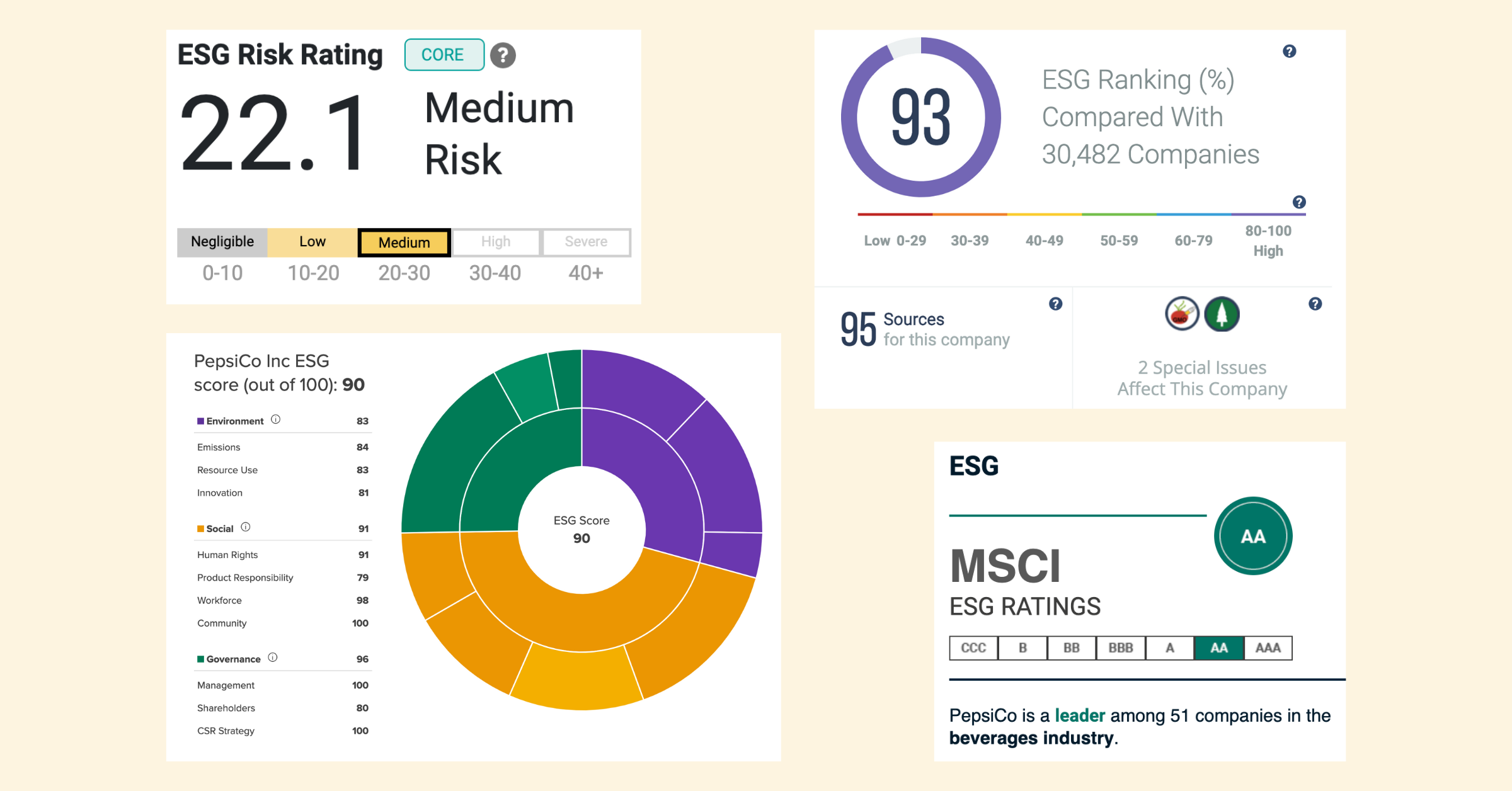

The three leading ESG ratings companies are MSCI, Sustainalytics (a Morningstar subsidiary), and Refinitiv (formerly Thomson Reueters).

What are the problems with ESG scores?

The are three core issues with ESG scores today. First, there is a lack of standardization in the way ESG factors are defined and weighted; this makes it difficult to compare ratings and sends mixed signals to investors and companies. Second, there is a lack of transparency in the way ratings are calculated; this makes it difficult to assess the validity of the ratings. Finally, ESG ratings are often based on self-reported data and claims, which can be biased, inaccurate, or baseless.

1. No ESG Score Standards

While there are standards for ESG reporting, there is no standard for ESG scoring. As a result, there is no consistent criteria used by ESG rating agencies and their rating results vary.

In an MIT Sloan study of six prominent ESG rating agencies, only a moderate correlation between ESG scores was found, as opposed to a very strong correlation between credit ratings (source).

“The finding suggests that ESG ratings do not properly reflect ESG performance, making it difficult for decision-makers to identify outperformers and laggards.”

Divergence in ratings gives mixed signals to companies about what to focus on improving.

3 factors driving ESG ratings divergence:

- Scope divergence – ratings are based on different attributes

- Measurement divergence – measure same attributes but use different data

- Weights divergence – assign attributes different levels of importance

2. Lack of transparency in how ESG ratings are calculated

Bloomberg reports “MSCI, the largest ESG rating company, doesn’t even try to measure the impact of a corporation on the world. It’s all about whether the world might mess with the bottom line…MSCI doesn’t dispute this characterization. It defends its methodology as the most financially relevant for the companies it rates.” (source)

So whats the problem?

Fund managers use ESG scores like MSCI’s ESG Rating to select companies for their ESG funds, which are often advertised to investors as being more sustainable and ethical ways to invest in the public markets.

3. ESG scores are not based on material performance

More than 1,200 former “ESG funds”–representing $1.2 trillion in assets–were stripped of their ESG label, exemplifying greenwashing through false claims and self-reported data (source). Morningstar said they removed the label from “funds that say they consider ESG factors in the investment process, but that don’t integrate them in a determinative way for their investment selection.” These funds represented 20% of all ESG Funds at the time.

Just 35% of public companies publishing sustainability reports had their reports assured1 by an external party (source). In other words, 65% of public company ESG reports are NOT ensured. It’s worth noting, while there are standards for sustainability assurance set by intergovernmental organizations like the International Standards Organization (ISO), assurance standards are not regulated or enforced.

1Assurance is the process of having a certified third-party audit a company’s sustainability report to make sure it is accurate and reliable.

“Rating agencies often assess companies on the quality of disclosures, or whether they have policies in place, rather than on actual performance… It is hard to know which, if any, scores indicate material performance,” said a sustainable asset manager in an interview with Greenbiz (source).

How do product sustainability scores help ESG investors & companies?

Conventional ESG reports and ratings rarely look at the scope 3 health and sustainability impacts of a companies products.

However, for consumer-goods companies’ a huge portion of their sustainability impact and their environmental, social, and governance risks are embedded in their upstream and downstream (scope 3) impacts.

Investors need product-level sustainability data in order to order to avoid serious ESG risks and make smart investment decisions that have a material positive impact in the world–preventing climate change, creating workplace equity, protecting public health, etc.

Product sustainability scores cut through the baseless ESG claims and targets to show exactly what a company is selling, it’s alignment with conscious capital and consumer trends, and its impact on people and the planet.

About GreenChoice

GreenChoice collects, analyzes, & rates product-level health and sustainability data for consumers, companies, and investors.

We’ve developed a patent-pending ontology and taxonomy for fast, evidence-based product sustainability data collection, analysis, and scoring–using natural language processing (NLP) to automate the processing of 130+ vetted public data sources and over 28 million data points.

GreenChoice has already evaluated the dietary, health, and climate impacts of over 2,000 food brands and more than 360,000 products.